Roll-up is one of the oldest tricks in the playbook to get big. This is a strategy involving the acquiring of multiple smaller companies and consolidating them into a large company.

Combining small firms into a larger company allows the latter to gain cost synergies, as well as revenue synergies via higher pricing power.

In my career, I have invested in a few companies that became multi-baggers during their roll-up phase.

Hence, my investment ears were pricked up when I met Johnny Jan, Executive Chairman and CEO of Winking Studios (“Winking”), early this year.

At that time, Winking was planning to list in Singapore and use its IPO proceeds to conduct acquisitions and strategic alliances.

This is the playbook of a roll-up strategy, and was executed by a similar company in the UK - Keywords Studios. Keywords has seen its share price increase 12x from GBP123 (at IPO) to GBP1498, resulting in a GBP$1.2 billion market cap. One big driver was the roll-up of gaming studios over the past ten years.

Similarly, Winking could be Keywords part II and be a multi-bagger if the company successfully executes its roll-up strategy of consolidating gaming art studios in Asia.

Hence, I am excited about the prospects of Winking.

Yesterday, despite a weak IPO market, Winking still managed to eke out a 5% gain from its subscription share price of $0.20. This puts it at a market cap of S$59m.

Here are some insights:

Game Art Outsourcing Company

Growth Plans in Asia

Comprehensive Client base

Recovery in earnings

IPO Term sheet

Game Art Outsourcing Company

Winking is an art outsourcing and game development studio that provides end-to-end art outsourcing and game development services across various platforms such as console, PC, online, and handheld content for the video games industry.

The company was founded in 2004 by Mr. Johnny Jan (Executive Chairman and CEO) and has over 20 years of established track record.

Winking has more than 700 highly skilled workforce of art talents, designers and scriptwriters. The company has developed more than 8 self-developed games, as well as 13 internationally renowned third-party games such as New World by Amazon Games; Madden NFL 22 by Electronic Arts; Assassin’s Creed Valhalla by Ubisoft and Identity V by NetEase.

Winking has three key business segments:

Art Outsourcing Segment where digital art assets are developed including 2D concept art, 3D modelling, 2D animation, 3D animation and visual effects;

Game Development Segment, where game development services are created including programming, development, design and script writing of games; and

Global Publishing and Other Services Segment, where internally produced game products as well as third party game developers on global game platforms including PlayStation, Switch and Steam, are established.

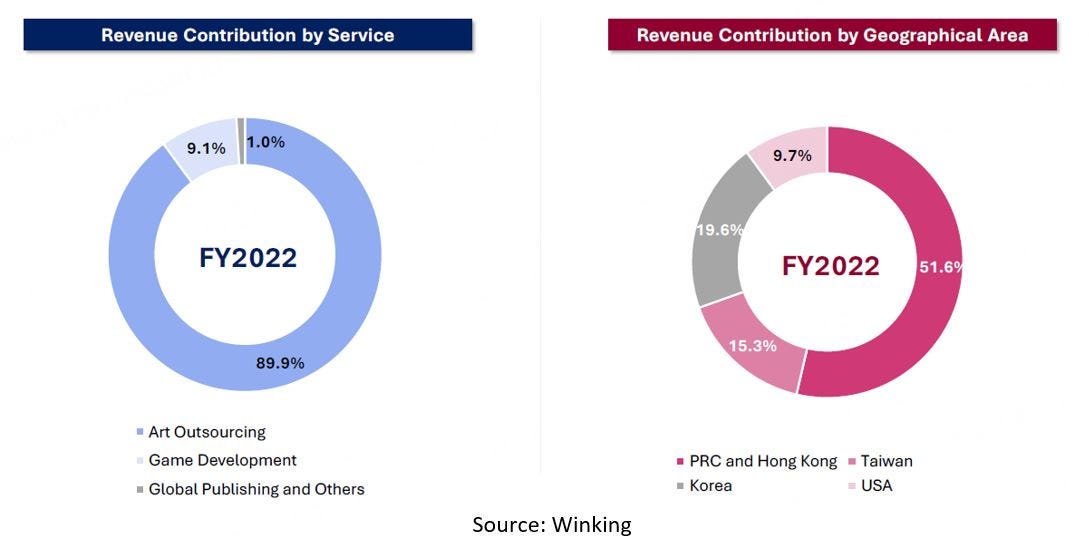

As of FY2022, Art Outsourcing Segment contributed 89.9% to the total revenue, with the remaining 9.1% and 1.0% contributed by Game Development Segment Global Publishing and Other Services Segment respectively.

PRC and Hong Kong has the largest revenue contribution of 51.6%, followed by Korea, Taiwan and USA with 19.6%, 15.3%, 9.7% respectively.

Comprehensive Client base

Winking possessed comprehensive game development knowledge and expertise as well as a strong data security management system.

The company enjoys strong international brand recognition, with collaboration with 19 of the top 25 global game development companies. This includes miHoYo, the developer of hit multiplayer video game Genshin Impact, NetEase, NCSOFT, Gamania, Ubisoft Shanghai and Rayark International.

As an art outsourcing service provider, the company is able to offer a full suite of art asset creation services, covering 2D character art and scene art, 3D modelling, animation and other related game art assets. This makes Winking an end-to-end game development studio, with the requisite know-how, expertise and capabilities to handle the full game development cycle.

Winking has an established partnership with three of the major game publishing platforms, namely, Sony, Microsoft MSFT 0.00%↑ and Nintendo. This has been in place for a number of years, resulting in a strong reputation among its customers.

Growth Plans in Asia

Winking is the third largest art outsourcing and game development studios in Asia, and fourth in the world, according to Independent Market Report from China Insights Consultancy

With offices and teams predominantly based in Singapore, Taiwan and China, Winking is able to tap into additional business and growth opportunities in the Asian markets, putting them at a competitive advantage over their US and European competitors.

As part of its expansion plans, Winking is expected to significantly grow its existing headcount of 700 skilled art workers by establishing operations in Malaysia and Philippines. This will help Winking to overcome its constraints in the availability of skilled workers, as well as ensure strong revenue growth in the coming years.

The company is also pursuing a roll-up strategy to acquire smaller design studios in Asia, as well as explore AI capabilities in its art outsourcing segment.

As seen in the latest Apple iPhone15, mobile gaming is expected to receive a strong boost with the powerful A17 Pro silicon and new GPU. This will raise the bar for game graphics, leading to increased spending on game art.

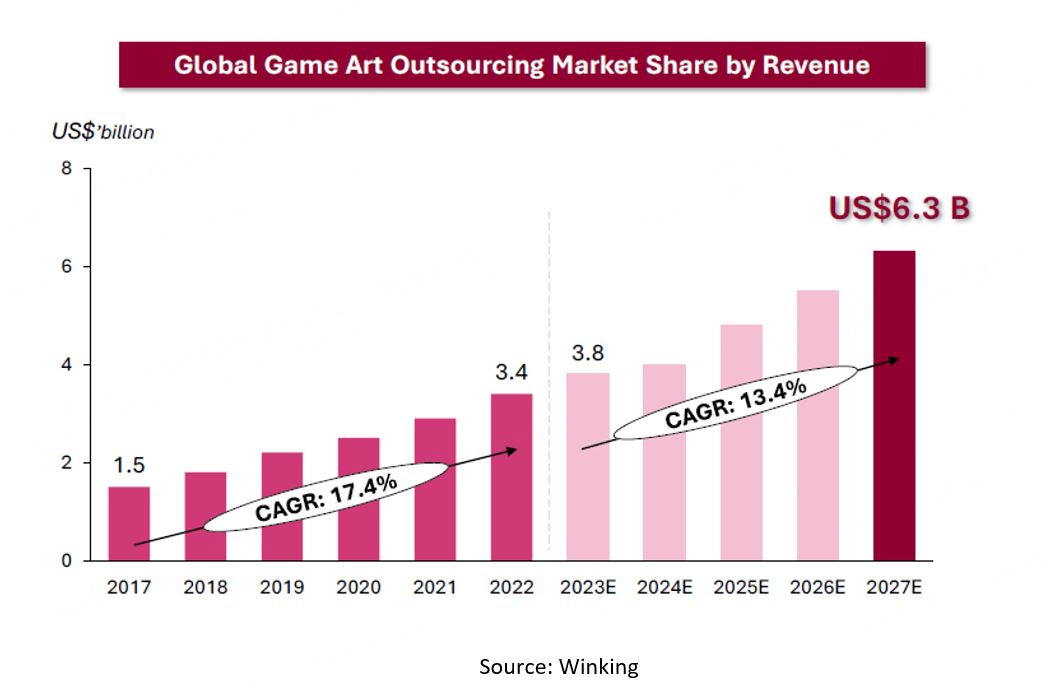

As a leading game art outsourcing studio, Winking will be a strong beneficiary of the rise in mobile gaming. The global game art outsourcing industry is already growing rapidly, from $1.5 billion in 2017 to $3.4 billion in 2022, and is expected to grow at 13.4% in the future.

Backed by Acer

Winking is majority owned by Acer Gaming, part of the Acer group of companies. This has enabled WinKing to tap onto an extensive network of relationships in the game development and art outsourcing industries, as well as an in-depth understanding of the gaming industry in Asia. To maintain its 51% stake in Winking, Acer will subscribe an additional $2.2m in the IPO, demonstrating confidence in the potential of Winking.

Acer’s chairman and chief executive Jason Chen has also subscribed to the placement shares of the IPO in his personal capacity.

Recovery in earnings

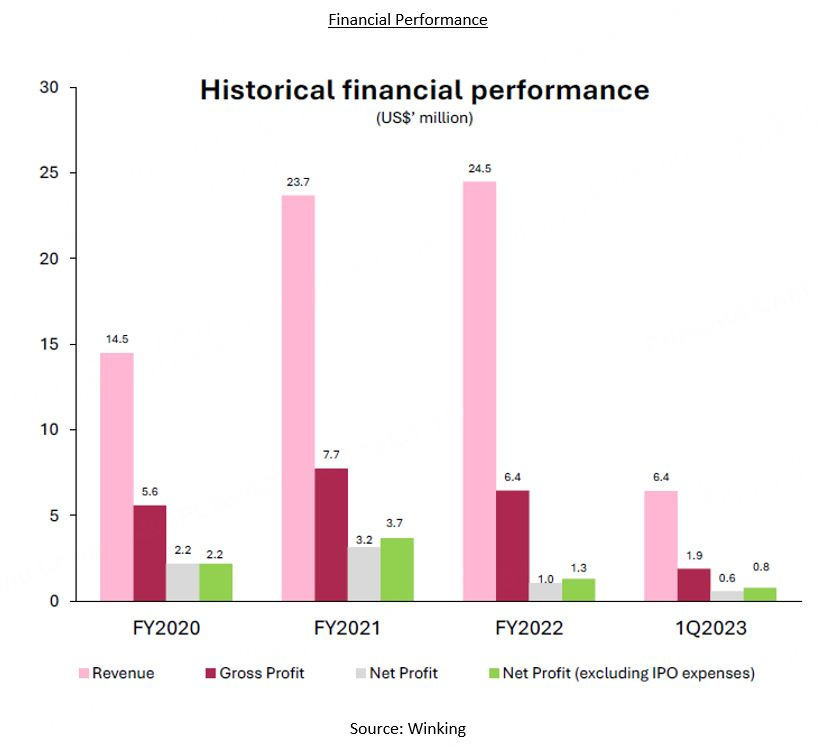

Revenue increased 3.4% to US$24.5 million in FY2022 mainly due to the increase in revenue from Art Outsourcing Segment. For the latest 1Q2023, revenue increased by 6.0% to US$6.4 million in 1Q2023, as a result of increased contribution from the Game Development Segment.

Profit fell 67.1% to US$1.04 million in FY2022. This is mainly due to the suspension of the publication licence grant to game developers in the PRC in late 2021, as well as higher expenses of US$0.9 million in relation to the IPO listing exercise.

For the latest 1Q2023, profit decreased by 11.0% to US$0.56 million compared to 1Q2022. This is due to an increase in distribution and marketing expenses, as well as higher expenses of US$0.3 million in relation to the IPO listing exercise.

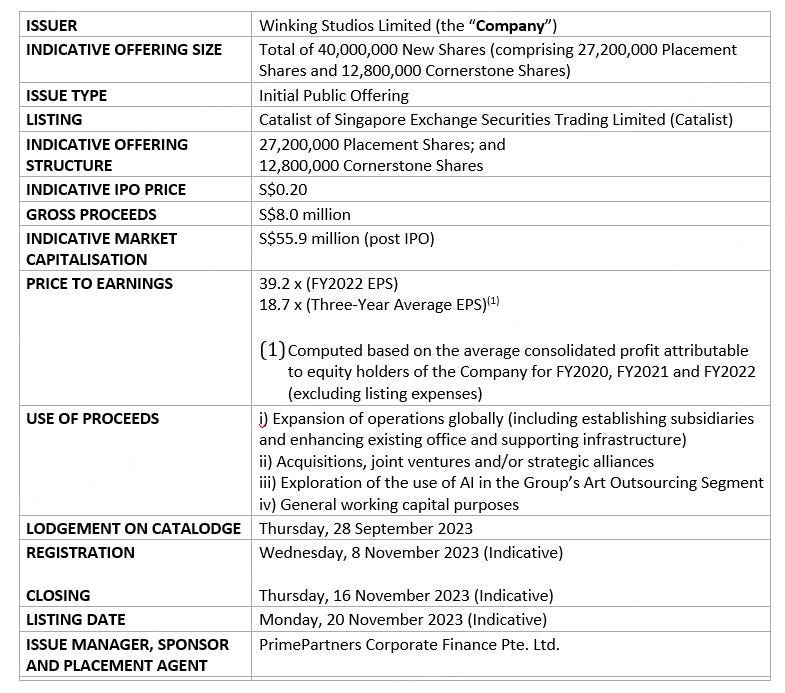

IPO Term sheet

(Source: PrimePartners Corporate Finance)