With the US airstrikes on Houthi rebels, Red Sea tensions could turn the financial market into a sea of red.

Here are some insights:

Oil Shock

Shipping Disruption

Inflation Threats

Oil Shock

Following the Yemen attacks, oil prices surged by 2.4% to approach $74 per barrel. The market could be pricing in further geopolitical escalation, considering Iran's support for the Houthis,

Iran is one of the largest crude producers in the Middle East, with an estimated daily production of 3.4 million barrels. Any escalation involving Iran has the potential to trigger an oil shock.

In the past, Tehran has threatened to close the vital Strait of Hormuz, a transit route vital for 17% of global oil supplies. This could result in a significant disruption to crude flows in the region, and send oil prices to a much higher level of around $100.

Shipping Disruption

For the past two months, the attacks by Houthi rebels on merchant shipping have disrupted shipping.

Major shipping companies such as Maersk and MSC, have stopped traveling through the Red Sea and opted for the longer route around the Cape of Good Hope.

Bypassing the Red Sea on a Hong Kong to London journey results in:

34% increase in the shipping distance from 9616 to 12929 miles

35% increase in the shipping journey from 40 to 54 days

Furthermore, shippers must navigate rough weather around the infamous "Cape of Storms" during the Southern winter.

As a result, ocean freight rates have skyrocketed, with rates for Asia-to-North Europe more than doubling, surpassing $4,000 per 40-foot container.

One beneficiary of the Red Sea chaos is ZIM Integrated Shipping Services ZIM 0.00%↑, one of the ten largest container shipping companies globally.

The company could benefit from higher freight rates as it has one of the highest exposure to freight rates. Currently, ZIM has around 75% exposure to spot freight rates, surpassing the industry average of 45%.

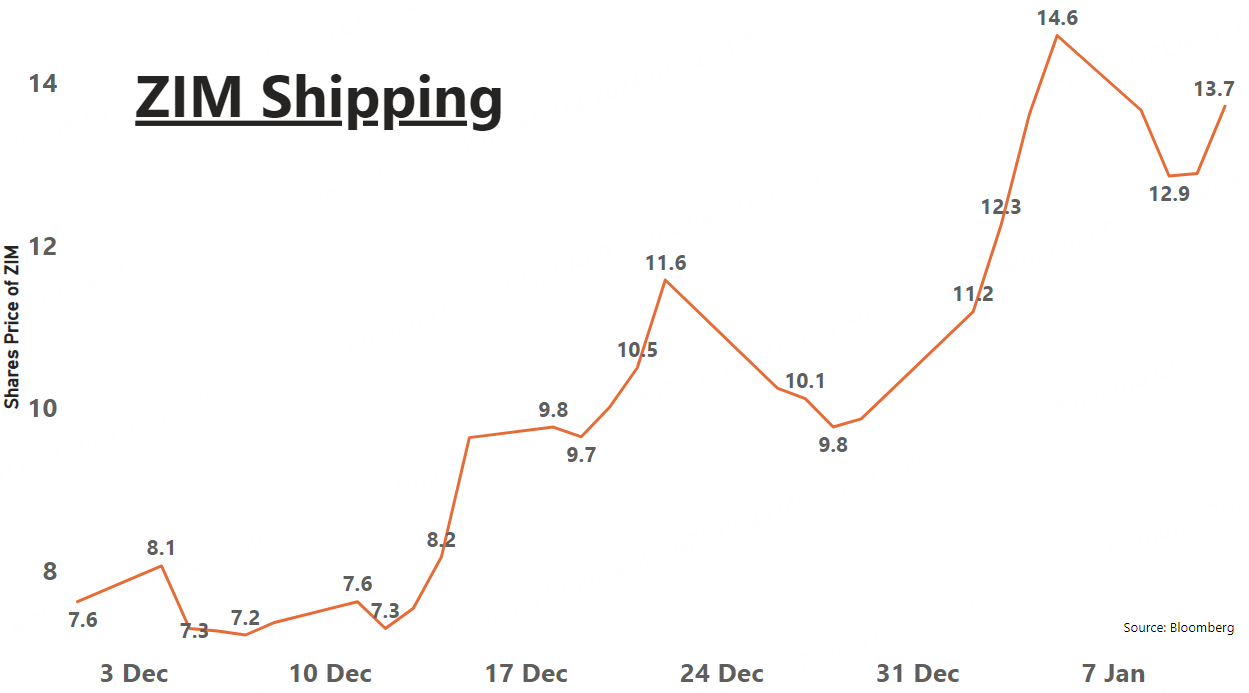

ZIM is trading at 4.7x EV/EBITDA and is expected to incur losses for FY23 due to the weak freight rates. Hence, the rising freight rates could result in a turnaround for ZIM. Already, the stock price of ZIM has risen by 39% this year, as well as doubled since early December.

Inflation Threats

In the aftermath of the Yemen attacks, US President Joe Biden declared that he "will not hesitate to direct further measures to protect our people and the free flow of international commerce as necessary". This signals a potential for heightened tensions in the Middle East.

Recent months have welcomed a retreat in inflation, with S&P 500 Index rising 14% since early November. Ten-year yields have also fallen 100bps during this period.

This respite may be short-lived if the sustained surge in shipping costs and oil prices persists. Escalating input prices could hurt the profitability of businesses and delay rate cuts by the US Fed this year. This could result in a sea of red for the financial markets.